The US has run a current account deficit for much of the past thirty years. This paper presents reasons for why this dynamic has persisted, paying particular attention to the importance of the reserve currency status of the dollar. The status as reserve currency has created a special dynamic whereby the short-run value of the dollar is affected by shifts in asset preferences of both foreign and domestic investors. A mechanism which increases the attractiveness of dollar assets will increase the dollar value in the short run; a stronger dollar then acts as a tax on US production and a subsidy for US consumption. In the long run, asset preference shifts toward dollar assets decrease the equilibrium value of the dollar and increase the equilibrium level of debt for the US. This paper presents three reasons for asset preference shifts into dollars and dollar denominated assets: international transaction demand, safety from balance of payment crises, and export led growth through an artificially competitive currency peg. I review work by Triffin (1960) that presents the dilemma of transaction demand for the holder of the reserve currency, and present historical evidence of the safety and export growth mechanisms. In the second section, this paper presents and extends work on the long run value of the dollar following a model by Blanchard, Giavazzi, and Sa (2005). Asset preference shifts that have occurred in past year are modeled, and finally I speculate on the future path of the dollar and international investment position of the US.

Introduction

One of the most interesting and rich topics in macroeconomic theory revolves around the study of currency movements and exchange rates. Over the past three decades, academic and financial analysis that argued the US would suffer dollar devaluation due to national consumption exceeding national production has been largely wrong. That such an intuitive argument has been so consistently wrong is the source of much frustration and consternation. What has become clear is that when discussing exchange rates and determinants of exchange rates, there is a necessary delineation between the dollar and the rest of the world currencies. Because the dollar is the world reserve currency, special dynamics exist for it in addition to the normal trade and monetary dynamics one would expect. In this paper, I identify three mechanisms that create a demand for dollars independent of trade dynamics: liquidity needs of the non-US world, security of assets for countries with irresponsible fiscal policy, and strategic export driven growth by developing countries. I argue that any force which increases this demand for dollars will also increase the trade and current account deficits, and vice-versa.

The position of this paper is that the US dollar is significantly overvalued in relation to its long run equilibrium value. I define equilibrium value for the dollar as the value at which the current account equals to zero . Since interest payments on net international debt are a key determinant of the current account, I also examine recent developments in that area.

The current account is made up by the trade balance plus any difference in payments between domestic owned foreign assets and foreign owned domestic assets. It is assumed in the paper that the Marshall-Lerner condition holds, and a depreciation of the currency not only increases exports, but improves the trade balance. Since US carries its debt in dollars, a depreciation of the dollar will also improve the current account balance. I feel the current account is the most effective measure of equilibrium in the long run because on some level it represents the relative competitiveness of US made goods and services on the international stage.

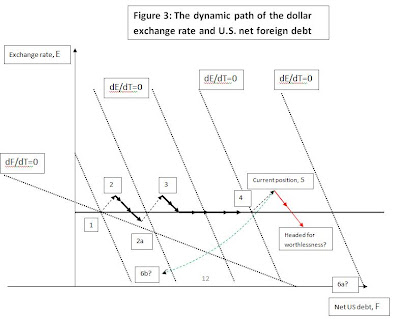

In the second part of the paper, I extend work done by Blanchard, Giavazzi, and Sa (2005) using phase diagrams to model global shifts in asset preferences. The three mechanisms which have created exogenous demand for dollars can be modeled as asset preference shifts. I model a specific shift that occurred in the last 9 months (August 2008-March 2009), and conclude with two alternative future paths that the dollar may take to achieve steady state in the model. These two paths are a discontinuous devaluation of the dollar probably accompanied by a shedding of the reserve currency status, and a relatively slower devaluation of the dollar accompanied by an ever-growing net international debt position of the US.

A Picture of Imbalance

The U.S. has run a current account deficit for almost all of the past thirty years, and it has recently increased in both absolute terms and as a percentage of GDP (Figure 1; Data from Fred Fed).

Figure 1: US Current Account.

Source: St. Louis Fed

It has been suggested that the current account (CA) deficit of the US is sustainable due to dark matter (Hausmann and Sturzenegger, 2007); generally speaking, theories along these lines suffer from a dangerous combination of wishful thinking, attempts to fit theory to the short term facts, and obfuscation of simple truths through complex and impressive mathematical arguments. The same types of theories have been developed in the past to explain that securitization of mortgages reduces systemic risk, and why housing prices and other assets must always go up. Relying on assertions that the US has complete markets, or that US investors can return a higher yield on their investments is both speculative and dangerous. While risk-averse foreign investors with poorly developed financial markets might make a marginally lower yield in the long run, this difference is greatly exaggerated during economic booms (when risk- taking is rewarded) and reversed in economic busts (when risk-taking is punished). The negative change of more than $2 trillion in the net foreign asset position of the US during 2008 (Figure 2) casts an already long shadow upon theories that the US can offset its CA deficit with financial genius.

Figure 2: Cumulative Net International Investment Position of the US.

Source: Gian Maria Milessi Ferreti; http://www.voxeu.eu/index.php?q=node/2902

I assert that the safe and logical assumption for the present time should be that the US cannot earn a significantly higher rate of return on foreign assets than vice-versa. This point becomes important for long-run considerations of equilibrium in the current account – namely, the US will have to run a trade surplus equal to interest payments on its net foreign debt position.

Nevertheless, strong arguments do exist for why the dollar remains strong. There are (at least) three sources of demand for dollars that exert an exogenous force on normal balance of trade dynamics: (1) a demand for dollar liquidity for transaction needs; (2) a foreign desire for asset security found in the dollar’s role as a reserve currency; and (3) developing country attempts to accelerate economic growth through an export dominated economy. To date all three factors have increased the incentive for foreigners to collect dollars (by selling goods and services in exchange for dollars) and decreased the incentive to dishoard dollars (by buying goods and services with the dollars). If these dynamics were to reverse, they would exert pressure to devalue the dollar above and beyond pressures exerted by the balance of trade dynamics. Below I expand on each of these exogenous sources of demand for dollars.