An interesting truth emerges from the discussion in the previous post http://outsidetheboxecon.blogspot.com/2009/10/some-graphics-on-us-fiscal-position.html: for a given theoretical maximum rate of repayment of debt (government budget surplus), the interest on the debt must be less than (rate of repayment)*GDP/(total debt). Let me give an example. If the theoretical maximum budget surplus is 5% of GDP, and debt is 80% of GDP, then any interest rate over 6.25% would mean the country was insolvent. In this case, inflation and economic growth are an enemy of the state, for if nominal GDP growth>6.25% the country is insolvent, but so long as inflation+GDP growth<6.25% the country can remain solvent. For a country like Japan with a debt 170% of GDP, a maximum budget surplus of 5% of GDP would imply that nominal GDP growth>3% implies insolvency for the country. This is a worry that has been getting no small amount of play in the media recently, as the demographics of Japan are decreasing the savings rate and major Japanese investment entities are starting to divest themselves of Japanese (Samurai) bonds. Looking back at this reality though, it is no wonder they have had a lost decade!

The issue of a necessary current account surplus presents another dilemma for US policy makers. How do we get a budget surplus without an accompanying current account surplus? This is, by definition, limited by the amount that savings exceeds investment:

(1) Budget surplus/deficit (taxes-gov spending) + domestic (saving-investment) = CA (exports-imports)

And how do we get a Current Account surplus without decreasing the relative value of our currency (which in turn stokes inflation)? The only way that I can see this is possible is if there is significant deflation in other countries. This would allow us to devalue our currency while not stoking domestic inflation. However, is this likely in an era of tightening supplies of oil and other natural materials? Not unless we have a concurrent worldwide depression. Healthy economic activity will lead to higher natural resource prices and worldwide inflation pressures.

Of course, this dilemma is inoperative until there is some demand for repayment of money loaned to the US government. But when that day comes, healthy economic activity and inflation abroad would lead to a default on US borrowing.

Saturday, October 31, 2009

Some graphics on the US fiscal position

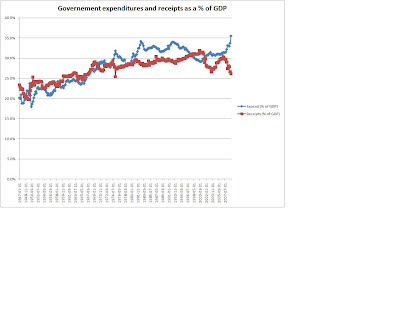

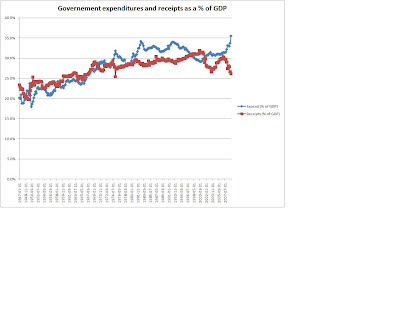

At the end of my last post, (http://outsidetheboxecon.blogspot.com/2009/10/revisiting-effects-of-oil-on-gdp.html) I mentioned that we were between a rock and a hard place as far as the fiscal situation of the US goes. Below are some graphics to show the history of our government expenditures, receipts, and deficit. All of the underlying data in this post are taken from two pages (GDP, FISCAL sections) of the St. Louis Fed website. http://research.stlouisfed.org/fred2/

Perhaps the most salient point is that since 1947, expenditures have never represented a higher percentage of GDP while government receipts are the lowest percentage of GDP since 1967! (PLEASE CLICK ON THE PICTURES TO ENLARGE)

Peter Bernholz's work studying hyperinflation has been cited widely in the financial press recently. In his most recent book, Monetary Regimes and Inflation: History, Economic and Political Relationships, Bernholz analyzes the 12 largest episodes of hyperinflations - all of which were caused by financing huge public budget deficits through money creation. His conclusion: the tipping point for hyperinflation occurs when the government’s deficit exceed 40% of its expenditures. This is mathematically equivalent to when expenditures>1.67*receipts. The graph below illustrates this ratio through 2009q2; it will continue to deteriorate for at least 2 more quarters and probably several more after that.

Peter Bernholz's work studying hyperinflation has been cited widely in the financial press recently. In his most recent book, Monetary Regimes and Inflation: History, Economic and Political Relationships, Bernholz analyzes the 12 largest episodes of hyperinflations - all of which were caused by financing huge public budget deficits through money creation. His conclusion: the tipping point for hyperinflation occurs when the government’s deficit exceed 40% of its expenditures. This is mathematically equivalent to when expenditures>1.67*receipts. The graph below illustrates this ratio through 2009q2; it will continue to deteriorate for at least 2 more quarters and probably several more after that.

Just as alarming from a creditor perspective is that government receipts are lower now, in real terms, than they were in 2000! The fundamental ability of any entity to service its debt has an upper bound determined by two variables: available revenue, and creditor faith. Of course practically speaking, costs cannot drop to zero, but from a strictly theoretical perspective, revenue provides an upper bound to how fast the debt can be repaid.

The faith of creditors is integral because it determines the interest on the debt. If the interest on the debt was >30% we would already be incapable of servicing our debt even if the government had zero expenditures. It is amazing how quickly a country can go from totally credit worthy to bankrupt just based on the perception of risk from investors. As David Einhorn put it in a recent newsletter: "events can move from the impossible to the inevitable without ever stopping at the probable."http://www.google.com/url?sa=t&source=web&ct=res&cd=1&ved=0CAwQFjAA&url=http%3A%2F%2Fblogs.reuters.com%2Frolfe-winkler%2Ffiles%2F2009%2F10%2Feinhorn-vic-2009-speech.pdf&ei=IpjsSqPFLIPitQO9wqkI&usg=AFQjCNFgutUHC6D5SrkLIdnsRYQUnfSJMQ&sig2=PuTUGdIgrXiJf3ej-OVFtA a pithy interpretation

A FIRST PASS AT FUTURE DEBT REPAYMENT

To get an idea of what would be necessary to repay the government debt, we look at revenue stream, future expenditures, perception of risk, and nominal GDP growth.

First let's suggest a maximum theoretical revenue stream available to the US. The historical maximum (in % of GDP) for receipts is 31.9%, achieved in the first quarter of 2000. [WWII and the early 1980s both had percentages approaching 30% of GDP]. There is good reason to think that we cannot achieve a rate much greater than 30% of GDP. This is because the incentive to dodge taxes goes up exponentially with the tax rate. There is also an argument that high tax rates disincentivize the activity that is being taxed (particularly true for capital gains taxes.) For the purpose of argument, let's be generous and assume that we can achieve a sustainable rate of taxation of 32% of GDP. With this assumption, we can say that the US must default if the interest payments on our debt exceed 32% of our GDP. We are far off from that point now, as the interest on our debt represents only 5% of our receipts, and a little over 1% of GDP.

At first glance, 1% appears to be a pretty safe number. However, there are several things that must be true to keep it at that level. Most obviously, we must stop increasing the debt:GDP ratio. Most importantly however, market interest rates cannot rise. The current low cost of servicing out debt is merely a function of record low interest rates. These record low interest rates are dependent on two things: the nominal market interest rate must continue to hover around zero, and creditors must not perceive a risk of default. Market interest rates are (essentially) zero now only because those are the current expectations for returns. If the market shifts to the perception that GDP growth is sustainable, then interest rates will increase by an amount corresponding to the shift in perception. It is likely that fiscal and monetary policy will remain accommodative

until this perception changes! Therefore, we will continue to increase debt levels and increase monetary stimulus until perceptions of future growth, and the real interest rate, shift. So it is only a matter of time until the interest on the US debt will rise. If the average interest on US debt rose to a very modest 5%, interest payments would suddenly jump to 10% of our maximum receipts. Keep in mind that these calculations are made on our maximum receipts, not maximum budget surplus. Expenditures in the future will certainly not be zero.

Incorporating a realistic but austere forecast of expenditures, let's say that the country can cut government expenditures to 15% of GDP (which is less than half of our current expenditures of 35.5% of GDP). To be clear, cutting government spending to this level would seem draconian: social safety nets would be cut, defense spending would be decimated, medicare and social security would only be token programs, etc. We would be down essentially to education, a reduced military, bare-bones infrastructure spending, and emergency local and state services. With this austere assumption, the budget surplus could theoretically be 15% of GDP; even in this best-case scenario however, a 5% market interest rate would imply 20% of our budget surplus would go simply to service debt, and only 80% to pay down the principal.

Finally, and most importantly, we come to the risk premium demanded by investors. If investors think (for whatever reason) that there is an "x" percent chance of default, than the interest on government bonds will be approximately x%+real market rate. Let's illustrate this with an example: if the market perceives a 10% risk that the US will default on half its debt, then the risk premium charged on debt would be 5%. So if the nominal market rate of interest was 5%, and investors felt they were risking 5%(10% chance of losing half their principal) of their capital to default, the real rate would be 10%. A budget surplus of 5% of GDP with an interest rate of 10% on our current debt would imply that we were spending 120% of our surplus on servicing the debt. If we could not increase this rate of repayment, then we would be in default. You can see how quickly a loss of faith results in insolvency.

Adding in the element of inflation and GDP growth completes the picture. I talk about this more in the next post http://outsidetheboxecon.blogspot.com/2009/10/inflation-in-china-default-in-us.html, but briefly, the rate of inflation needs to be added to the real interest rate to give a nominal interest rate. If there is a 5% rate of inflation and 3% rate of GDP growth, even with a zero percent risk of default, the nominal interest rate would be about 8%. This would mean even a 5% current account surplus would not be sufficient even to service the debt on the US balance sheet.

Perhaps the most salient point is that since 1947, expenditures have never represented a higher percentage of GDP while government receipts are the lowest percentage of GDP since 1967! (PLEASE CLICK ON THE PICTURES TO ENLARGE)

Peter Bernholz's work studying hyperinflation has been cited widely in the financial press recently. In his most recent book, Monetary Regimes and Inflation: History, Economic and Political Relationships, Bernholz analyzes the 12 largest episodes of hyperinflations - all of which were caused by financing huge public budget deficits through money creation. His conclusion: the tipping point for hyperinflation occurs when the government’s deficit exceed 40% of its expenditures. This is mathematically equivalent to when expenditures>1.67*receipts. The graph below illustrates this ratio through 2009q2; it will continue to deteriorate for at least 2 more quarters and probably several more after that.

Peter Bernholz's work studying hyperinflation has been cited widely in the financial press recently. In his most recent book, Monetary Regimes and Inflation: History, Economic and Political Relationships, Bernholz analyzes the 12 largest episodes of hyperinflations - all of which were caused by financing huge public budget deficits through money creation. His conclusion: the tipping point for hyperinflation occurs when the government’s deficit exceed 40% of its expenditures. This is mathematically equivalent to when expenditures>1.67*receipts. The graph below illustrates this ratio through 2009q2; it will continue to deteriorate for at least 2 more quarters and probably several more after that.

Just as alarming from a creditor perspective is that government receipts are lower now, in real terms, than they were in 2000! The fundamental ability of any entity to service its debt has an upper bound determined by two variables: available revenue, and creditor faith. Of course practically speaking, costs cannot drop to zero, but from a strictly theoretical perspective, revenue provides an upper bound to how fast the debt can be repaid.

The faith of creditors is integral because it determines the interest on the debt. If the interest on the debt was >30% we would already be incapable of servicing our debt even if the government had zero expenditures. It is amazing how quickly a country can go from totally credit worthy to bankrupt just based on the perception of risk from investors. As David Einhorn put it in a recent newsletter: "events can move from the impossible to the inevitable without ever stopping at the probable."http://www.google.com/url?sa=t&source=web&ct=res&cd=1&ved=0CAwQFjAA&url=http%3A%2F%2Fblogs.reuters.com%2Frolfe-winkler%2Ffiles%2F2009%2F10%2Feinhorn-vic-2009-speech.pdf&ei=IpjsSqPFLIPitQO9wqkI&usg=AFQjCNFgutUHC6D5SrkLIdnsRYQUnfSJMQ&sig2=PuTUGdIgrXiJf3ej-OVFtA a pithy interpretation

A FIRST PASS AT FUTURE DEBT REPAYMENT

To get an idea of what would be necessary to repay the government debt, we look at revenue stream, future expenditures, perception of risk, and nominal GDP growth.

First let's suggest a maximum theoretical revenue stream available to the US. The historical maximum (in % of GDP) for receipts is 31.9%, achieved in the first quarter of 2000. [WWII and the early 1980s both had percentages approaching 30% of GDP]. There is good reason to think that we cannot achieve a rate much greater than 30% of GDP. This is because the incentive to dodge taxes goes up exponentially with the tax rate. There is also an argument that high tax rates disincentivize the activity that is being taxed (particularly true for capital gains taxes.) For the purpose of argument, let's be generous and assume that we can achieve a sustainable rate of taxation of 32% of GDP. With this assumption, we can say that the US must default if the interest payments on our debt exceed 32% of our GDP. We are far off from that point now, as the interest on our debt represents only 5% of our receipts, and a little over 1% of GDP.

At first glance, 1% appears to be a pretty safe number. However, there are several things that must be true to keep it at that level. Most obviously, we must stop increasing the debt:GDP ratio. Most importantly however, market interest rates cannot rise. The current low cost of servicing out debt is merely a function of record low interest rates. These record low interest rates are dependent on two things: the nominal market interest rate must continue to hover around zero, and creditors must not perceive a risk of default. Market interest rates are (essentially) zero now only because those are the current expectations for returns. If the market shifts to the perception that GDP growth is sustainable, then interest rates will increase by an amount corresponding to the shift in perception. It is likely that fiscal and monetary policy will remain accommodative

until this perception changes! Therefore, we will continue to increase debt levels and increase monetary stimulus until perceptions of future growth, and the real interest rate, shift. So it is only a matter of time until the interest on the US debt will rise. If the average interest on US debt rose to a very modest 5%, interest payments would suddenly jump to 10% of our maximum receipts. Keep in mind that these calculations are made on our maximum receipts, not maximum budget surplus. Expenditures in the future will certainly not be zero.

Incorporating a realistic but austere forecast of expenditures, let's say that the country can cut government expenditures to 15% of GDP (which is less than half of our current expenditures of 35.5% of GDP). To be clear, cutting government spending to this level would seem draconian: social safety nets would be cut, defense spending would be decimated, medicare and social security would only be token programs, etc. We would be down essentially to education, a reduced military, bare-bones infrastructure spending, and emergency local and state services. With this austere assumption, the budget surplus could theoretically be 15% of GDP; even in this best-case scenario however, a 5% market interest rate would imply 20% of our budget surplus would go simply to service debt, and only 80% to pay down the principal.

Finally, and most importantly, we come to the risk premium demanded by investors. If investors think (for whatever reason) that there is an "x" percent chance of default, than the interest on government bonds will be approximately x%+real market rate. Let's illustrate this with an example: if the market perceives a 10% risk that the US will default on half its debt, then the risk premium charged on debt would be 5%. So if the nominal market rate of interest was 5%, and investors felt they were risking 5%(10% chance of losing half their principal) of their capital to default, the real rate would be 10%. A budget surplus of 5% of GDP with an interest rate of 10% on our current debt would imply that we were spending 120% of our surplus on servicing the debt. If we could not increase this rate of repayment, then we would be in default. You can see how quickly a loss of faith results in insolvency.

Adding in the element of inflation and GDP growth completes the picture. I talk about this more in the next post http://outsidetheboxecon.blogspot.com/2009/10/inflation-in-china-default-in-us.html, but briefly, the rate of inflation needs to be added to the real interest rate to give a nominal interest rate. If there is a 5% rate of inflation and 3% rate of GDP growth, even with a zero percent risk of default, the nominal interest rate would be about 8%. This would mean even a 5% current account surplus would not be sufficient even to service the debt on the US balance sheet.

Saturday, October 24, 2009

Revisiting effects of oil on GDP

Over the next week, I will revisit a paper that I wrote last year predicting the effect of high oil prices on GDP. In short, however, I would say that the lion's share of the effects of high oil prices on the economy have passed for now. Of course it is impossible to know what prices lie in the future, but so long as oil prices stay below $115, the effects on the economy will be minimal. In fact, since there appears to still be at least some resource slack in the system, there is room for above-trend growth starting in 2010q3 and lasting until 2011q2 or until oil prices move above their previous highs.

My prediction for quarterly growth (using oil price and consumption as the only determinant!) is as follows:

2009q3:+0.7%

2009q4:+1.4%

2010q1:+2.3%

2010q2:+2.8%

2010q3:+3.6%

2010q4:+3.8%

2011q1:+4.4%

2011q2:+4.4%

Of course there are wide error bars on these predictions and there are other determinants of GDP, but the wide brush prediction here is that resource prices are supportive of improving economic growth in the US.

The other determinant I would keeping a close eye on is of course the degree to which fiscal and monetary authorities continue their stimulative efforts. If the stimulative efforts are withdrawn, then this is going to create a negative effect on GDP for several quarters. Note also that we may be between a rock and a hard place when it comes to this subject. If we try to continue stimulative efforts (either fiscal or monetary) and foreigners balk at further bond purchases, or lower the value of the dollar, then this will undoubtedly cause oil prices to spike. So we will see.

Conclusion: although there is a menacing cloud still on the horizon, the weather should be good for the next several quarters!

My prediction for quarterly growth (using oil price and consumption as the only determinant!) is as follows:

2009q3:+0.7%

2009q4:+1.4%

2010q1:+2.3%

2010q2:+2.8%

2010q3:+3.6%

2010q4:+3.8%

2011q1:+4.4%

2011q2:+4.4%

Of course there are wide error bars on these predictions and there are other determinants of GDP, but the wide brush prediction here is that resource prices are supportive of improving economic growth in the US.

The other determinant I would keeping a close eye on is of course the degree to which fiscal and monetary authorities continue their stimulative efforts. If the stimulative efforts are withdrawn, then this is going to create a negative effect on GDP for several quarters. Note also that we may be between a rock and a hard place when it comes to this subject. If we try to continue stimulative efforts (either fiscal or monetary) and foreigners balk at further bond purchases, or lower the value of the dollar, then this will undoubtedly cause oil prices to spike. So we will see.

Conclusion: although there is a menacing cloud still on the horizon, the weather should be good for the next several quarters!

Wednesday, October 7, 2009

Revisiting Triffin's Dilemma, and gold as an escape hatch

This will probably be my last post on gold for awhile. I want to move back into energy issues over the next few weeks, but I felt there were a few more things that I wanted to say about gold. I will return to the paper I wrote in March on the dollar and comment on what appears to be a growing reality - that gold's use as a monetary asset is waxing.

The paper I wrote in March commented on the special dynamics that apply to the US dollar, that prevent the adjustments one would expect from a country with a large and persistent trade deficit. http://outsidetheboxecon.blogspot.com/2009/03/dollar-and-impending-currency-crisis_24.html While there seems to have been a marginal resumption of the bearish dollar trend, anecdotal evidence appears to support the idea that foreign asset preferences remain favorable to the dollar (the past 5 months of TIC reports are one piece of anecdotal evidence that this is the case.) Furthermore, although foreign creditors such as China have been vocal in their opposition to large US deficits, their actions do not match their words. Trade deficits and budget deficits have a strong correlation http://en.wikipedia.org/wiki/Twin_deficit_hypothesis. The Chinese might want the US to have more fiscal responsibility. However, the continued pegging of the Yuan (and pegging of other trade partners) to the dollar means that either the US government or the US citizenry must be in deficit. It has been widely observed that the US consumer is "tapped out" and is not going into more debt. So long as the Chinese, Saudis, etc, keep their exchange rates pegged at stimulative levels, either the US consumer or the US government will have to be in deficit. Actions speak louder than words, and the continued currency peg means that the Chinese prefer a US deficit (either public or private) to a fairly valued currency.

As much as the Chinese want a pegged currency for economic reasons however, they are now realizing that at some point their store of dollars will not be worth much in real terms. The possibility of replacing the dollar as the reserve currency is immaterial to this fact. Regardless of whether the US dollar is replaced as the reserve currency, its value will decline so long as economic activity is healthy. The fact that gold remains as a monetary asset that cannot be devalued is a fact that I think is slowly dawning on the large dollar holders of the world. It is for this reason, more than any other, that the continued increase in gold price is assured. Gold will be the safety valve, the escape hatch, and the attempted route out of the dollar holder dilemma.

I like to theorize about various options the Chinese face in dealing with their large dollar foreign exchange holdings. Assuming that they will at some point realize their dilemma of dollar exposure, how might they go about a change? If you feel I have missed any possibilities, please feel free to comment below.

Option 1: Increase the value of the Yuan

Costs: 1) decrease in exports, employment, and GDP

2) a decrease in the value of the dollar relative to the Yuan decreases the nominal Yuan value of foreign exchange holdings.

Benefits: 1) Increased purchasing power of the Yuan.

2) Long-term financial and economic health of the US is increased. Since the majority of foreign exchange is held in US dollars, this means the long term real value of these holdings might be stabilized.

Option 2: Continue the pegging of the Yuan.

This is the inverse of option 1

Costs: 1) Supporting a dynamic that results in continued budget deficits or private deficits (S-I<0) in the United States. Since the majority of foreign exchange is held in dollars, this destabilizes the long term real value of the large Chinese foreign exchange. This is a cost that may well be discontinuous, meaning that it will seem to be a small cost, and then dramatically shift to being a huge or total loss. Amazingly, this cost seems not to have dawned on the Chinese monetary authorities until after the 2008 financial crisis.

2) Decreased purchasing power of the Yuan; so long as economic activity is robust, this increases the price of real goods (particularly energy) and would stimulate inflation in China, (in spite of sterilization by the CB.)

Benefits: 1) Continued strength in exports support short-term employment and GDP goals.

2) Continued pegging allows the nominal value of Chinese foreign exchange to remain high in Yuan terms.

Option 3: Continue pegging but divest foreign exchange into gold and other real assets

Benefits: 1) Allows the continuation of advantageous trade terms. Exports>Imports keeps employment and GDP numbers high.

2) Nominal Yuan value of foreign exchange holdings are maintained.

3) Real value of foreign exchange holdings are maintained due to a diversification into real assets.

4) Dependence on the long-term solvency and productive capacity of the US is decreased.

Costs: 1) Potential for a bubble to form in real assets (particularly real monetary assets such as silver and gold).

2) The real value of foreign exchange will still go down since the possible scale of divestment into real assets is limited compared to the size of forex reserves.

In essence the costs of option 3 are more subtle but still present: either the amount of divestment is not significant, or it will create bubble values in the assets that are chosen for diversification. In spite of these costs, I think that option 3 probably represents the smoothest transition for Chinese and other dollar holders out of their dollar trap dilemma.

For the US the implications of this strategy will be increased financial stability, but an increase in the cost of real goods in the US market. The Federal Reserve will continue to be placed in an untenable position: any attempt to head off inflation will increase the value of the dollar but immediately crash the US economy. This appears to be the holding pattern that we are currently in, but I imagine that we will need to go through at least one more iteration of crashing the economy before the Fed catches on to this dynamic.

The paper I wrote in March commented on the special dynamics that apply to the US dollar, that prevent the adjustments one would expect from a country with a large and persistent trade deficit. http://outsidetheboxecon.blogspot.com/2009/03/dollar-and-impending-currency-crisis_24.html While there seems to have been a marginal resumption of the bearish dollar trend, anecdotal evidence appears to support the idea that foreign asset preferences remain favorable to the dollar (the past 5 months of TIC reports are one piece of anecdotal evidence that this is the case.) Furthermore, although foreign creditors such as China have been vocal in their opposition to large US deficits, their actions do not match their words. Trade deficits and budget deficits have a strong correlation http://en.wikipedia.org/wiki/Twin_deficit_hypothesis. The Chinese might want the US to have more fiscal responsibility. However, the continued pegging of the Yuan (and pegging of other trade partners) to the dollar means that either the US government or the US citizenry must be in deficit. It has been widely observed that the US consumer is "tapped out" and is not going into more debt. So long as the Chinese, Saudis, etc, keep their exchange rates pegged at stimulative levels, either the US consumer or the US government will have to be in deficit. Actions speak louder than words, and the continued currency peg means that the Chinese prefer a US deficit (either public or private) to a fairly valued currency.

As much as the Chinese want a pegged currency for economic reasons however, they are now realizing that at some point their store of dollars will not be worth much in real terms. The possibility of replacing the dollar as the reserve currency is immaterial to this fact. Regardless of whether the US dollar is replaced as the reserve currency, its value will decline so long as economic activity is healthy. The fact that gold remains as a monetary asset that cannot be devalued is a fact that I think is slowly dawning on the large dollar holders of the world. It is for this reason, more than any other, that the continued increase in gold price is assured. Gold will be the safety valve, the escape hatch, and the attempted route out of the dollar holder dilemma.

I like to theorize about various options the Chinese face in dealing with their large dollar foreign exchange holdings. Assuming that they will at some point realize their dilemma of dollar exposure, how might they go about a change? If you feel I have missed any possibilities, please feel free to comment below.

Option 1: Increase the value of the Yuan

Costs: 1) decrease in exports, employment, and GDP

2) a decrease in the value of the dollar relative to the Yuan decreases the nominal Yuan value of foreign exchange holdings.

Benefits: 1) Increased purchasing power of the Yuan.

2) Long-term financial and economic health of the US is increased. Since the majority of foreign exchange is held in US dollars, this means the long term real value of these holdings might be stabilized.

Option 2: Continue the pegging of the Yuan.

This is the inverse of option 1

Costs: 1) Supporting a dynamic that results in continued budget deficits or private deficits (S-I<0) in the United States. Since the majority of foreign exchange is held in dollars, this destabilizes the long term real value of the large Chinese foreign exchange. This is a cost that may well be discontinuous, meaning that it will seem to be a small cost, and then dramatically shift to being a huge or total loss. Amazingly, this cost seems not to have dawned on the Chinese monetary authorities until after the 2008 financial crisis.

2) Decreased purchasing power of the Yuan; so long as economic activity is robust, this increases the price of real goods (particularly energy) and would stimulate inflation in China, (in spite of sterilization by the CB.)

Benefits: 1) Continued strength in exports support short-term employment and GDP goals.

2) Continued pegging allows the nominal value of Chinese foreign exchange to remain high in Yuan terms.

Option 3: Continue pegging but divest foreign exchange into gold and other real assets

Benefits: 1) Allows the continuation of advantageous trade terms. Exports>Imports keeps employment and GDP numbers high.

2) Nominal Yuan value of foreign exchange holdings are maintained.

3) Real value of foreign exchange holdings are maintained due to a diversification into real assets.

4) Dependence on the long-term solvency and productive capacity of the US is decreased.

Costs: 1) Potential for a bubble to form in real assets (particularly real monetary assets such as silver and gold).

2) The real value of foreign exchange will still go down since the possible scale of divestment into real assets is limited compared to the size of forex reserves.

In essence the costs of option 3 are more subtle but still present: either the amount of divestment is not significant, or it will create bubble values in the assets that are chosen for diversification. In spite of these costs, I think that option 3 probably represents the smoothest transition for Chinese and other dollar holders out of their dollar trap dilemma.

For the US the implications of this strategy will be increased financial stability, but an increase in the cost of real goods in the US market. The Federal Reserve will continue to be placed in an untenable position: any attempt to head off inflation will increase the value of the dollar but immediately crash the US economy. This appears to be the holding pattern that we are currently in, but I imagine that we will need to go through at least one more iteration of crashing the economy before the Fed catches on to this dynamic.

Speculation on the Gold/S&P ratio

Above and below you see a picture of the ratio between gold and the S&P (click for a larger picture.) This is a chart from 2000-present representing the fraction of one S&P index that can be purchased for one ounce of gold. It is a logarithmic chart, and you can see that from the minimum to the maximum, there was an increase of roughly a factor of 8.

To my eye, it looks like gold will likely advance on the S&P once again. It may be that there is a longer correction, or that there will be further consolidation, but it seems very likely that before any sustainable decline in this ratio, there would be one more retest of the maximum.

The ratio had its recent maximum value of 1.366 on March 6, 2009, one day before the low in the S&P. The ratio has backed off quite a bit in the past 6 months, reflecting the fact that the S&P has rallied more strongly than gold. The thing that I would like to point out is that it is very likely that we will see at the very least some sort of retest of the previous high in this ratio. The recent low in this ratio of 0.914 was put in on August 24th. A 50% retrace of the ratio to 1.14 would represent a pretty large shift in either gold or S&P at this point. Assuming the S&P stays put at 1050, this would imply gold would hit $1197. If gold stays put between $1000 and $1040, this would imply a correction of the S&P to between 880 to 910. A retest of the 1.36 ratio would put gold at $1425 or the S&P at 764. Take a good long look at the chart of the ratio again, and I think it is pretty clear that gold will make one more advance on the S&P.

Tuesday, October 6, 2009

New high in gold

We had a new high in gold this morning. The precious metal markets were looking jumpy on Sunday night, and we were seeing almost no determined selling. Almost all of the big market orders were buy orders, and you can see this on the charts by steep or parabolic moves up in price followed by largely lateral movement. This indicates large amounts of buying motivated by time, followed by consolidations with a firm bid to take any sellers.

This new high is NOT confirmed by either the dollar, silver, or the gold stock index. As I outlined at the beginning of last month http://outsidetheboxecon.blogspot.com/2009/09/silvergold-cleared-for-take-off.html this is the first of three events necessary to assure a healthy breakout. We are well on our way to the second condition being met. The dollar is close to breaking below support at 76, and getting to 75 would probably follow shortly. The third condition (a new high in the HUI and in silver) is still some ways distant, but that distance could be made up very quickly as these markets are capable of moving 5 or 6% in a day.

I had a funny dream over the weekend. I was with a friend and we were trading gold at an old board, the way things used to be traded back in the day. It was a large board with electronic prices of gold, silver, platinum, various gold and silver stocks, etc., essentially a trading pit dedicated to precious metals. In the dream, I had a large physical position that I had established with my friend, and we were watching the price of gold as it broke out through its old highs. It then went from $1000 to $10,000 in about 6 minutes, literally burning through the numbers! In the dream I remember frantically searching for a firm bid for physical, because I wanted to sell at $9,500. All of the orders getting filled were futures positions, and I was struggling to find a firm bid for the physical. It was a fun dream though.

Cheers to all,

Matt

This new high is NOT confirmed by either the dollar, silver, or the gold stock index. As I outlined at the beginning of last month http://outsidetheboxecon.blogspot.com/2009/09/silvergold-cleared-for-take-off.html this is the first of three events necessary to assure a healthy breakout. We are well on our way to the second condition being met. The dollar is close to breaking below support at 76, and getting to 75 would probably follow shortly. The third condition (a new high in the HUI and in silver) is still some ways distant, but that distance could be made up very quickly as these markets are capable of moving 5 or 6% in a day.

I had a funny dream over the weekend. I was with a friend and we were trading gold at an old board, the way things used to be traded back in the day. It was a large board with electronic prices of gold, silver, platinum, various gold and silver stocks, etc., essentially a trading pit dedicated to precious metals. In the dream, I had a large physical position that I had established with my friend, and we were watching the price of gold as it broke out through its old highs. It then went from $1000 to $10,000 in about 6 minutes, literally burning through the numbers! In the dream I remember frantically searching for a firm bid for physical, because I wanted to sell at $9,500. All of the orders getting filled were futures positions, and I was struggling to find a firm bid for the physical. It was a fun dream though.

Cheers to all,

Matt

Thursday, October 1, 2009

End of the quarter and social security

The quarter ended yesterday with gold above $1000. This is actually a new high for the end of a quarter and the end of a month. I believe this to be yet another signal that gold is likely to move higher; I think that we will have a new high in the gold price in October, and will challenge $1200 by the end of the year. It will be interesting to see what happens to the price of gold once it breaks significantly above the 2008 highs. Will the increase be gradual? Will it inspire some frenzy buying and then crash? Will it trigger a larger shift in consciousness or sentiment about fiat money?

We will see, and I don't think there will be long to wait.

On a related front, there was a news item over the last weekend on social security that surprised me. Apparently the social security system will be paying out more than it is taking in the year 2010! Wow.

http://news.yahoo.com/s/ap/us_social_security_early_retirements

If you read through the article it says at some point:

"Social Security has accumulated surpluses from previous years totaling $2.5 trillion"

You have to have a finely developed sense of irony and Orwellian humor to fully grasp this surplus. This "surplus" is nothing more than US treasury bonds, meaning that the government borrowed this money to pay for other things and deposited treasury bonds (debt) in its place. Kind of hard to wrap your mind around isn't it?

The bottom line is this: there is no surplus. A true surplus would be represented by some store of value such as cash, ownership in productive capacity, crude oil reserves, gold, real estate, etc! Instead, any social security taxes that were in excess of social security payments (the surpluses) were borrowed by the government and spent somewhere else on something else. There is no direct or proportional way that this spending will be returned to the social security trust fund. Thus the surplus has already been spent.

What will happen now is that the US will have to go into debt that much faster because the social security will be in deficit each year instead of surplus. The fact that the "trust fund" will not run out until 2037 is largely irrelevant. The trust fund can only be turned into real goods to the extent that the government can increase real taxes on the American population. The rubber hits the road in 2010, because that is the year that social security is in deficit, and there is no surplus of real goods or cash sitting anywhere.

This is one of the three most important economic challenges facing America. The other two are expensive/constrained energy production, and the end result of a monetary system based on debt and paper.

We will see, and I don't think there will be long to wait.

On a related front, there was a news item over the last weekend on social security that surprised me. Apparently the social security system will be paying out more than it is taking in the year 2010! Wow.

http://news.yahoo.com/s/ap/us_social_security_early_retirements

If you read through the article it says at some point:

"Social Security has accumulated surpluses from previous years totaling $2.5 trillion"

You have to have a finely developed sense of irony and Orwellian humor to fully grasp this surplus. This "surplus" is nothing more than US treasury bonds, meaning that the government borrowed this money to pay for other things and deposited treasury bonds (debt) in its place. Kind of hard to wrap your mind around isn't it?

The bottom line is this: there is no surplus. A true surplus would be represented by some store of value such as cash, ownership in productive capacity, crude oil reserves, gold, real estate, etc! Instead, any social security taxes that were in excess of social security payments (the surpluses) were borrowed by the government and spent somewhere else on something else. There is no direct or proportional way that this spending will be returned to the social security trust fund. Thus the surplus has already been spent.

What will happen now is that the US will have to go into debt that much faster because the social security will be in deficit each year instead of surplus. The fact that the "trust fund" will not run out until 2037 is largely irrelevant. The trust fund can only be turned into real goods to the extent that the government can increase real taxes on the American population. The rubber hits the road in 2010, because that is the year that social security is in deficit, and there is no surplus of real goods or cash sitting anywhere.

This is one of the three most important economic challenges facing America. The other two are expensive/constrained energy production, and the end result of a monetary system based on debt and paper.

Subscribe to:

Posts (Atom)